The Micro Invest Scheme, administered by Malta Enterprise, supports the growth and competitiveness of self-employed individuals and businesses by granting tax credits on eligible expenditure.

Following the publishing of Malta Budget 2026, the Micro Invest scheme has been enhanced, where essentially the capping on tax credits has been raised to €65,000 for Maltese businesses. Malta-based undertakings can avail of a tax credit of up to 65% eligible investment cost, with a higher capping for Gozo-based undertakings reaching €85,000.

The Micro Invest Scheme will now extend eligibility to include digital investments, thereby broadening the range of activities that may qualify for tax credits. Additionally, a new wage-support measure, where Malta Enterprise will subsidise 65% of wage increases, up to a maximum of €780 per employee annually, or €960 for employees based in Gozo, for individuals who have remained with the same employer for more than four (4) years, for a period of 2 years. This is designed in a manner to support salary progression for long-serving employees while alleviating additional burden on employers.

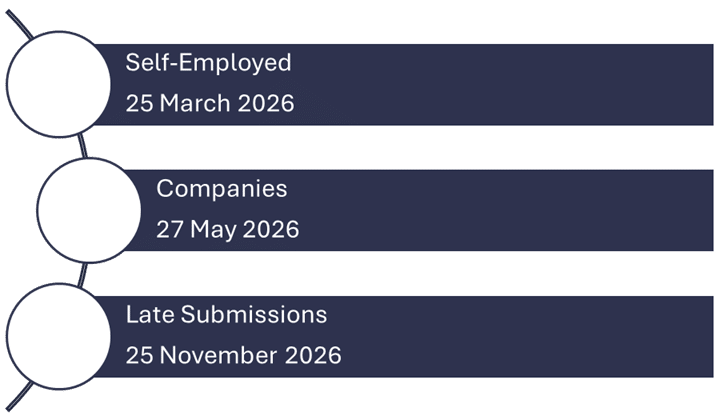

For those interested in availing from this scheme for expenditure incurred in 2025, these may be claimed in 2026 for which the guidelines may still be subject to further change. Accordingly, you are encouraged to contact our Advisory Team early on in 2026, in order to meet the deadlines, set for next year which are also outlined below.

Malta’s 2025 Merit-Based Citizenship: Key Takeaways from the Latest Legal Notice

Legal Notice 159 of 2025 amends the Granting of Citizenship for Exceptional Services Regulations (S.L. 188.06), reinforcing Malta’s commitment to national development, strategic goals, and solidarity under Malta Vision 2050.

Citizenship by Naturalisation on the Basis of Merit allows applicants to obtain Maltese citizenship by demonstrating exceptional merit or meaningful contributions aligned with Malta’s goals and values. Eligibility extends to the main applicant, their spouse, children under the age of eighteen (18), unmarried dependent children aged 18-29, and adult dependent children with a disability as defined by the Equal Opportunities Act.

The process consists of two (2) phases:

Step 1: Proposal Letter

Applicants outline their exceptional service or contribution, reviewed by the Community Malta agency, an independent Evaluation Board, and ultimately the Minister.

Step 2: Application

The application requires documentation such as proof of residence or property, evidence of contributions, language proficiency, and ties to Malta. After renewed due diligence and evaluation, the Minister decides on approval.

Successful applicants must submit a written statement undertaking and confirming continued compliance with obligations, take an Oath of Allegiance within six (6) months, and are then issued a Certificate of Naturalisation.

Simplified Company Dissolution Under Malta’s Companies (Amendment) Act, 2025

The Companies (Amendment) Act, 2025 (Act No. XVIII of 2025), published on 11 July 2025, which is expected to come into force later this year. It introduces several important changes to Maltese company law, most notably a new simplified procedure for dissolving private limited liability companies.

Under Article 214A, companies that have been registered for at least six (6) months may apply directly to the Registrar to be dissolved and struck off the register, provided they meet certain condition. A company will not be eligible if, in the previous six (6) months, it has changed its name, carried out business, employed staff other its offers, left filings or penalties unpaid, or if any shares have been pledged.

To apply, Directors must submit the relevant forms together with a declaration confirming that the Company:

- Is not regulated;

- Has settled or written off all liabilities;

- Has no pending legal cases;

- Has assets worth €5,000 or less;

- Has not entered into contracts in the last six (6) months except with service providers.

Companies must also confirm that government dues are settled, only officers remain employed, all bank accounts are closed, VAT de-registration (if needed) is filed, and a shareholders’ resolution has been passed.

Directors must ensure that beneficial ownership and financial records are properly retained, and they (together with the Company Secretary) remain responsible until the Company is officially struck off.

Once the application is accepted, the Registrar will publish a notice, and the company will be struck off after three months. This new procedure allows companies to close down without going through a formal liquidation process of appointing a liquidator.

Key Reforms to Malta’s Permanent Residence Programme (MPRP)

On 22 July 2025, the Residency Malta Agency announced significant revisions to the Malta Permanent Residence Programme (MPRP) through Legal Notice 146 of 2025. These changes aim to enhance the programme’s investment appeal by revising its pricing structure and introducing a new one-year temporary residence permit.

The temporary permit, issued at the outset of the application process following standard background checks, allows applicants to reside in Malta while competing the remaining programme requirements. All documentation must be submitted within six (6) months. If the application is approved and all obligations are fulfilled, the permit will automatically convert into a Permanent Residency Certificate. Inc cases of refusal, the temporary permit will be revoked within fifteen (15) days of notification.

Key financial revisions have also been introduced. The contribution due by the main applicant to the Residency Malta Agency, when opting to rent a property in Malta, has been reduced from €60,000 to €37,000. Furthermore, this revised contribution also applies to applicants purchasing a property, thereby removing the previous distinction between renting and buying.

Fee pertaining to dependants have also been adjusted, where spouses and minor dependants are now exempt from the previous €10,000 fee. For adult dependants included in the initial application, or added after approval, the contribution has been reduced from €10,000 to €7,500. Conversely, the non-refundable MPRP administration fee is now set at €60,000.

Additionally, further flexibility has been introduced, where applicants who own a qualifying property may lease it to third parties when not residing in Malta, subject to the Residency Malta Agency guidelines. Similarly, those leasing a qualifying property may sublet it with landlord consent after the initial five-year lease period. Licensed Agents are required to maintain a detailed log of clients leasing such properties.

These changes apply to all applications submitted on or after 1 January 2025.

Our Trail: Cultivating Enduring Progress

The Advisory Team has continued to grow its skills and expertise through a variety of internal and external workshops and training sessions. This proactive approach helps us stay ahead of industry expectations and ensures the services we provide are both high-quality and valuable to our clients. It also supports the ongoing development of every team member.

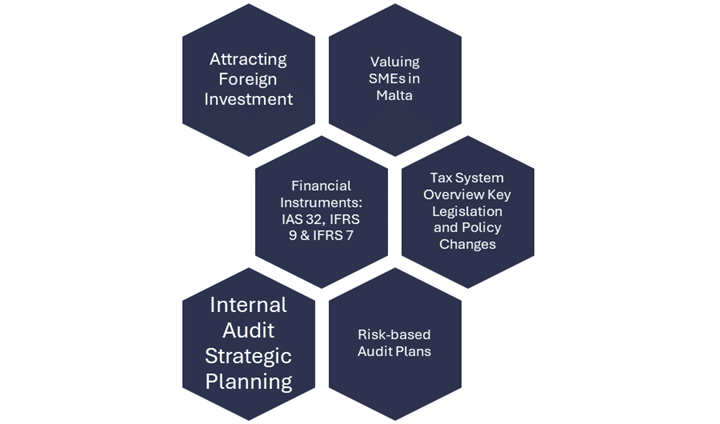

Over the past year, we have embraced every opportunity to expand our knowledge through engaging sessions on:

Milestones that Shaped our Journey

- Assisted in the listing process of a bond issue on the local market with the Malta Stock Exchange

- Reviewed expenditure allocations and relevant frameworks to support alignment with funding requirements for operations within the filming industry

- Reviewed internal processes and frameworks across multiple entities and provided targeted recommendations to strengthen controls, and drive enhanced efficiency

Assisted business enterprises and self-employed individuals in successfully applying and claiming tax credits, totalling approximately €3 million.